Kampala, Uganda | KalishoInfo — The banking landscape in Uganda is set for a major shake-up after Absa Bank Uganda announced it had signed an agreement to take over the Wealth and Retail Banking business of Standard Chartered Bank Uganda.

The deal, confirmed on Friday, brings to an end months of speculation following Standard Chartered’s announcement in November 2024 that it would explore the sale of parts of its business as part of a global realignment strategy.

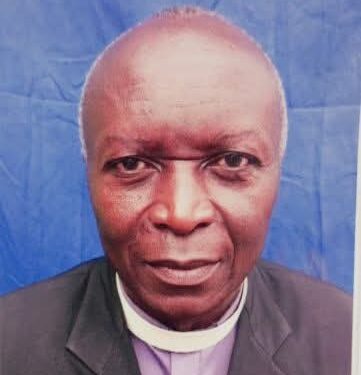

The signing ceremony took place at Standard Chartered’s head offices in Kampala and was witnessed by the bank’s Board Chairperson, Maria Kiwanuka, and Absa Bank Uganda’s Non-Executive Director, George Opio. It was attended by senior executives from both institutions, including Kariuki Ngari, CEO of Standard Chartered Kenya and Africa; Sanjay Rughani, Managing Director of Standard Chartered Uganda; and David Wandera, Managing Director of Absa Bank Uganda.

Under the agreement, all Standard Chartered’s retail and wealth clients, along with the employees who serve them, will be transferred to Absa Bank Uganda. Both banks said they are working closely to ensure a smooth transition without disruptions to customers.

“This marks an important milestone in executing our global strategy,” said Sanjay Rughani, adding that Standard Chartered will remain active in Uganda through its Corporate and Investment Banking arm. “We are confident that our clients and colleagues will be in excellent hands with Absa.”

Absa Group’s Executive for Africa Regions, Charles Russon, described the transaction as a strong signal of the group’s Pan-African ambitions. “It further strengthens Absa’s position in Uganda’s financial services landscape and enables us to deliver more value and convenience to customers,” he said.

Absa Uganda’s Managing Director, David Wandera, called the acquisition “a significant milestone” in the bank’s growth story. “It represents an opportunity to welcome new customers and colleagues into the Absa family while reaffirming our long-term commitment to Uganda’s economic development,” he noted.

The deal is still subject to regulatory approval from the Bank of Uganda and other authorities.

The move adds to a growing trend of realignment in Uganda’s financial sector as international lenders streamline their operations and regional banks expand their reach. For Absa, this deal not only deepens its market presence but also signals confidence in Uganda’s fast-evolving economy and growing middle class.

About Absa Bank Uganda

Absa Bank Uganda, a subsidiary of Absa Group Limited, is one of the country’s leading financial institutions. The bank officially rebranded from Barclays Bank Uganda in February 2020, marking the end of more than a century of the Barclays brand in Africa after the British lender reduced its shareholding in the African business.

With over 90 years of operation in Uganda, Absa offers a broad range of services spanning retail, business, and corporate banking. It has been at the forefront of digital innovation and financial inclusion, supporting both individuals and businesses through a network of more than 40 branches and hundreds of ATMs across the country.

Absa Group, headquartered in Johannesburg, South Africa, operates in 12 African countries and is listed on the Johannesburg Stock Exchange. The group continues to pursue growth through strategic acquisitions and expansion of its digital banking footprint across the continent.