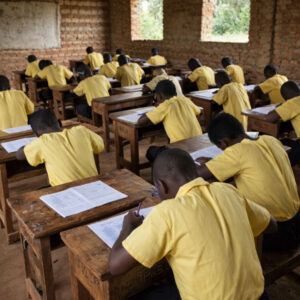

Kampala, Uganda – MTN Uganda, the country’s largest telecommunications provider, has come under fire following reports of unannounced increases in the prices of its monthly data bundles with many customers extending frustration as some users accuse the company of implementing the changes discreetly, raising questions about transparency and regulatory oversight.

The cost of certain monthly data bundles has risen without prior public communication. For instance, one user claimed that a 1.5GB monthly data bundle, previously priced at UGX 5,000, now costs UGX 6,500—an increase of 30%. Another user alleged that additional charges were deducted from their mobile account without consent, describing the adjustments as “stealing.” While these claims reflect customer sentiment, they remain unverified and require further investigation to confirm their accuracy.

MTN Uganda has not issued an official statement addressing the specific allegations of price hikes as of May 9, 2025. However, the company’s recent activities suggest a strategic shift in its data offerings. In November 2024, MTN announced enhancements to its WakaNet Home broadband service, including price reductions for 4G routers (from UGX 130,000 to UGX 99,000) and WakaNet MiFi devices (from UGX 75,000 to UGX 50,000), alongside the introduction of Gaga bundles for flexible data options. These updates were part of MTN’s “Ambition 2025” vision to improve affordability and accessibility. There is no indication in these announcements that mobile data bundle prices were adjusted, suggesting the changes may have been applied selectively or without broad publicity.

The lack of public disclosure about the alleged price increases has fueled speculation about MTN’s intentions. Industry observers note that telecom companies sometimes adjust pricing quietly to offset rising operational costs, such as those driven by inflation, currency fluctuations, or infrastructure investments. In December 2024, MTN Uganda secured a UGX 370 billion ($100 million) syndicated loan to fund network expansion, signaling significant capital expenditure. It’s plausible that price adjustments could be linked to these financial pressures, though MTN has not confirmed this.

Comparatively, MTN Nigeria’s 2025 data plan revisions, as reported in April 2025, showed a strategic move toward higher revenue by reducing ultra-cheap bundles and increasing costs for low-volume plans. While Uganda’s market differs, similar pressures—such as regulatory changes or declining voice revenue—may be at play. MTN Uganda reported a 20% profit jump in Q1 2025 despite a cut in mobile termination rates, indicating resilience but also potential cost-recovery measures.

The secrecy surrounding the price changes, if true, contrasts with MTN’s earlier transparency. In March 2023, the company publicly launched no-expiry Freedom Voice Bundles, with clear communication via press releases and its website. The absence of similar announcements for data bundle adjustments has led to accusations of poor customer engagement. Uganda’s telecom regulator, the Uganda Communications Commission (UCC), has not yet commented on the issue, but public pressure may prompt an investigation, as some users have tagged the UCC and other authorities in their complaints.

Customer dissatisfaction is evident, with calls for intervention from the Ministry of ICT, Parliament, and even the police. This backlash could harm MTN’s reputation, especially as competitors like Airtel Uganda and Lycamobile continue to challenge its market dominance with competitive data offerings.

The decision to implement price changes without public announcement—if accurate—may stem from several factors. First, telecom companies sometimes avoid publicizing price hikes to minimize customer churn, especially in competitive markets. Second, MTN may have viewed the adjustments as minor or targeted, not warranting a broad campaign. Finally, internal miscommunication or oversight could explain the lack of clarity, though this seems less likely given MTN’s scale and experience.